"Know what you own, and know why you own it." -Peter Lynch

At Gyoseki, we understand how much research goes into putting on an investment position. An investor typically analyzes its competitors, suppliers and customers, involving dozens of Management metings over several months.

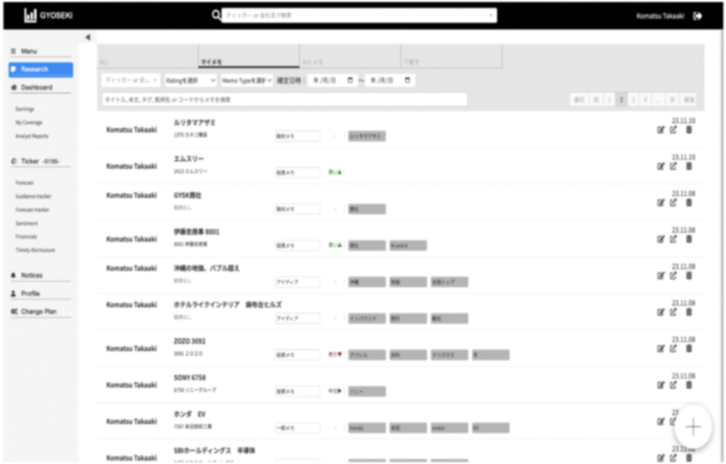

・How do you organize, sort and keep all this data?

・How do you share all this data with your teammates?

・How do you help your compliance officer help you and the firm?

"We all are learning, modifying, or destroying ideas all the time." -late Charlie Munger

After you finish your research and put on your position, how do you monitor it? We believe that your investment process doesn't end but rather starts when you buy a stock. We know that even Berkshire Hathaway, famous for investing long term (ideally forever) constantly monitors its positions.

Gyoseki is a Research Management System designed for investors, to help you visualize and simplify so you can focus on learning, modifying, or destroying ideas, instead of juggling between different systems.

News

The 2nd Gyoseki Competition in Partnership with Point72, JPX Market Innovation & Research, Nowcast, SCRIPTS Asia, and UZABASE (see detail)

Research Management for Investors

Information Management

Do you keep your notes locally and share information via email? Or does your team use shared drive?

You research 5 companies a day x 20 days a month. Your colleagues do the same.

Did you share all the information? If not, which ones did you share?

What happened to those which you didn't? Are they all lost?

Make things easier by keeping everything in one system.

Management's Responsibility

Are you currently doing your best to protect your firm?

What happens when staff leaves?

Gyoseki has a suite of additional features

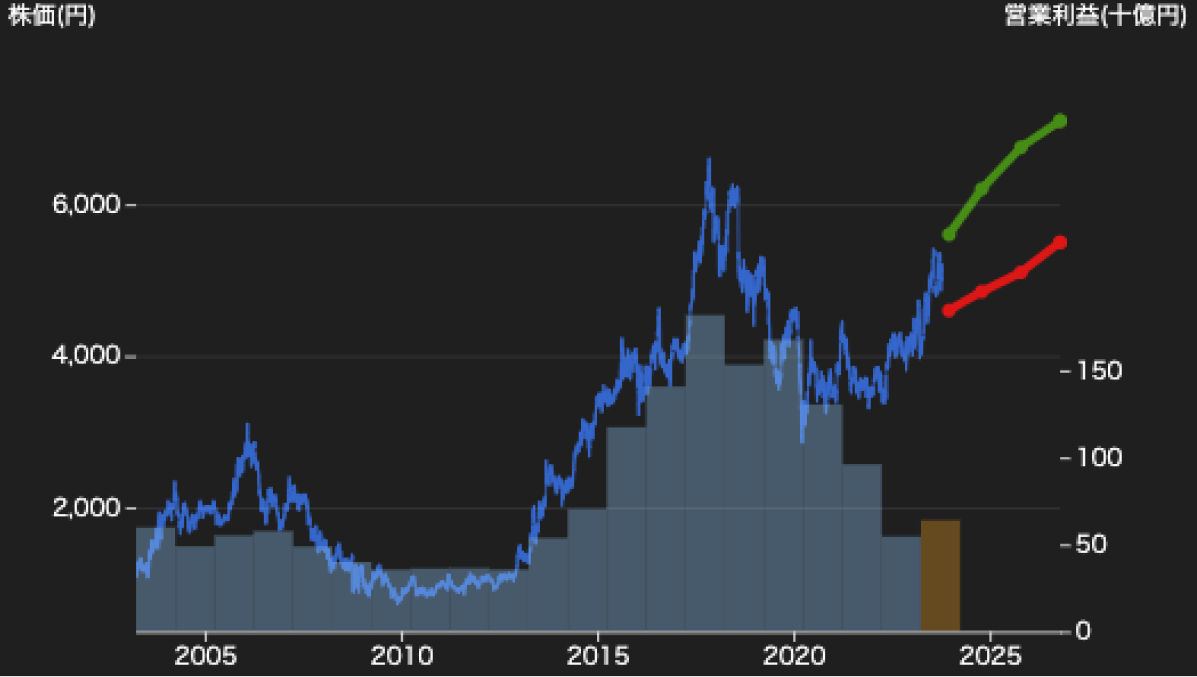

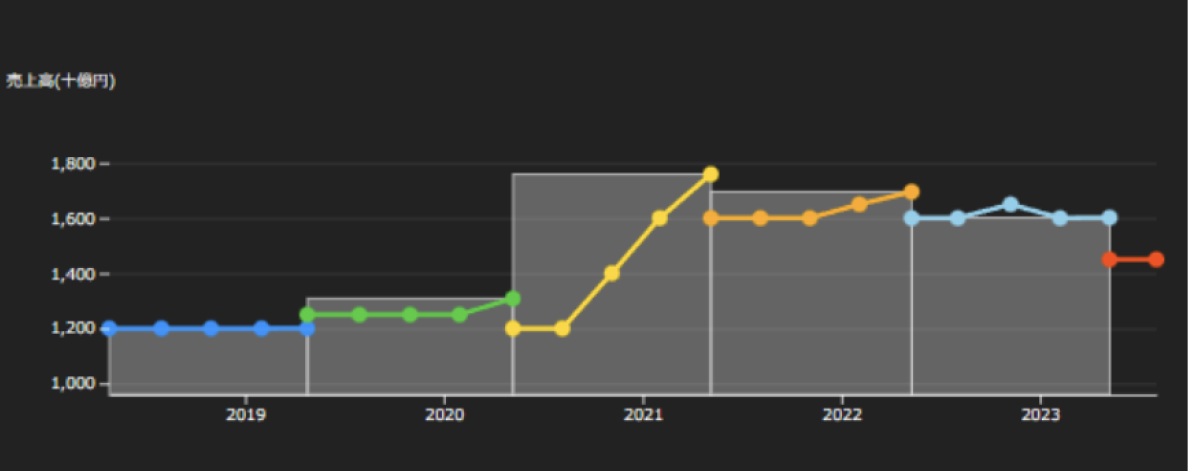

Visualize Target Price

What does my Target and Risk Prices mean?

Is it a new high or all time low?

When would it get there?

What’s the event path going forward?

Earnings Projection

Does my earnings forecast reflect my target price and investment rating?

How does it look 2-5 years out?

How do I compare with guidance?

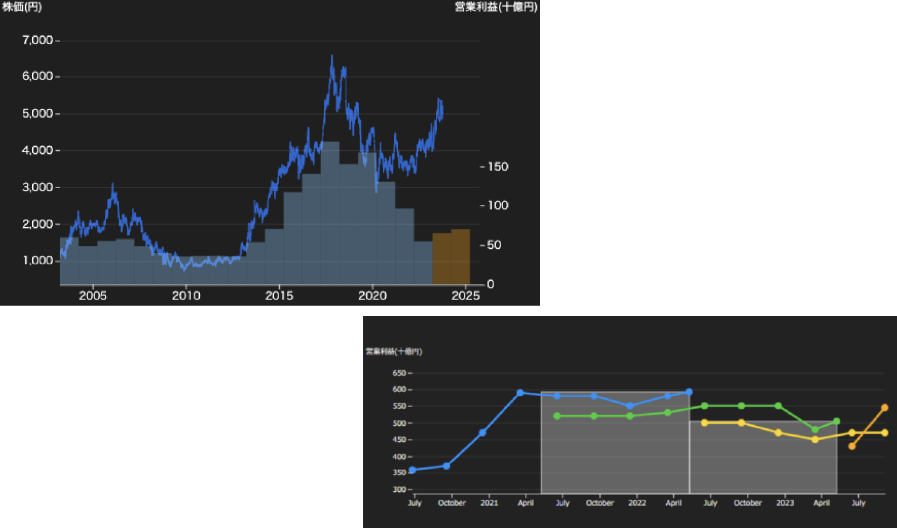

Guidance Tracker

Does the company provide realistic forward looking view, or does it manage expectations?

Does the company revise guidance often?

When does the company typically revise guidance? Before earnings? With Q2?

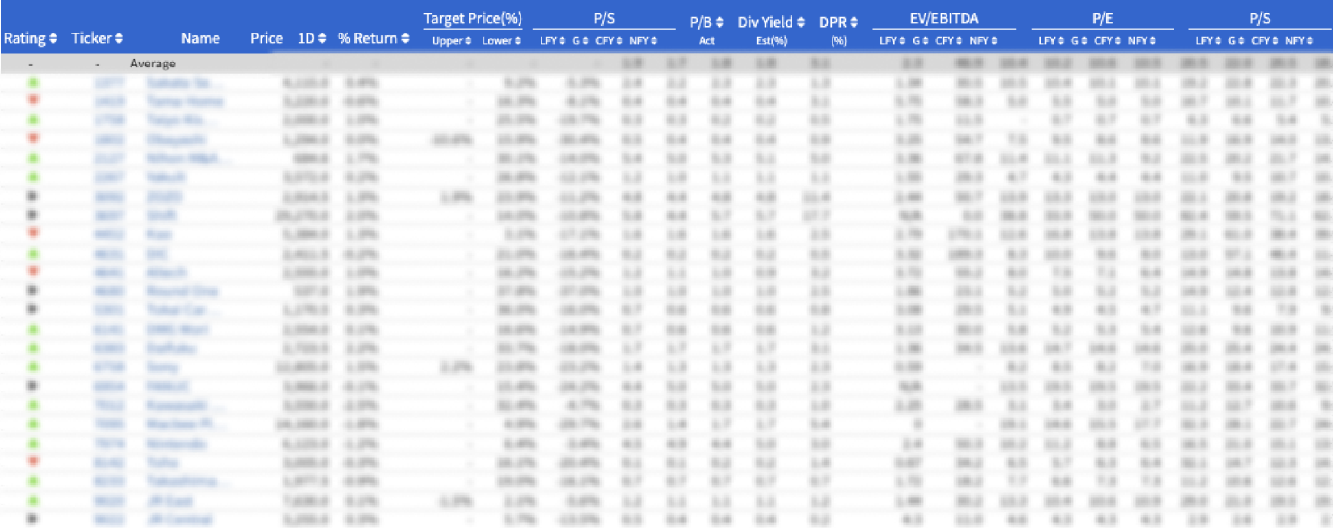

Coverage Dashboard

Do I have any stale coverage?

Any position that is close to my Target Price?

Are there any attractive stocks?

When is the next earnings date?